Nvidia has yet to report its third-quarter update, but it is already a standout winner in the megacap earnings season, positioned to benefit significantly from the increasing investment in artificial intelligence (AI) technologies and infrastructure in the coming years.

Over the past month, Nvidia’s stock (NVDA) experienced a 9.3% increase, surpassing the 0.5% advancement of the Nasdaq benchmark. This year, the company has gained more than $2 trillion in market value due to rising investments in AI technology and its dominance in the AI chip market. Nvidia is set to replace Intel (INTC) in the Dow Jones Industrial Average on November 8. With a market value of $3.3 trillion, Nvidia is currently the second-most valuable company globally, just behind Apple (AAPL).

Analysts at UBS anticipate the four leading hyperscalers—Google parent Alphabet (GOOGL), Facebook parent Meta Platforms (META), Amazon (AMZN), and Microsoft (MSFT)—to spend $267 billion next year on capital projects dedicated to new technologies, a 33.5% increase from this year’s projections. Amazon CEO Andy Jassy highlighted this as a “once-in-a-lifetime” opportunity in generative AI, with $200 billion expected to be spent on such projects this year alone.

Amazon plans to allocate around $75 billion to capital spending in 2024, mainly for technology infrastructure to support demand for AI services. Meta is targeting a rise in this year’s bill to between $38 billion and $40 billion, with a noticeable acceleration in infrastructure expenses anticipated next year. Microsoft, having spent $55.4 billion in the fiscal year ended June, is expected to invest $80 billion this year, while Google’s expenditure is projected at $51 billion. Even Tesla (TSLA), pursuing CEO Elon Musk’s ambitious goals for autonomous vehicles, plans to spend approximately $11 billion this year, largely due to AI computing investments.

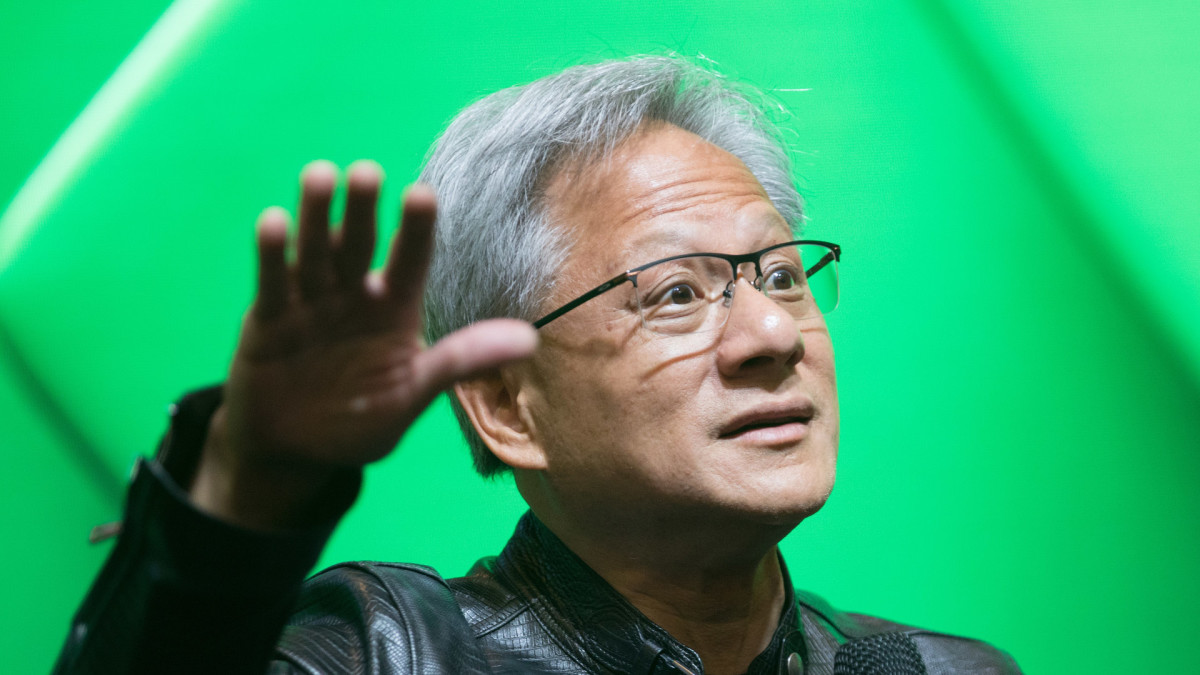

Nvidia holds an 80% share of the market for chips and processors crucial to the hyperscalers’ massive datasets and enterprise customers who want to utilize the technology in various sectors. CEO Jensen Huang described the demand for AI as “insane.” Meanwhile, AMD’s CEO Lisa Su predicted that the total addressable market for AI accelerators could expand annually by more than 60% to reach $500 billion by 2028. According to IDC estimates, total AI spending, including software, hardware, and services, is expected to more than double, from $235 billion last year to around $632 billion by 2028.

The semiconductor industry, generating $500 billion in sales last year from various technologies, sees Nvidia as the principal beneficiary with its new Blackwell line of chips and processors. CFRA analyst Angelo Zino stated that Blackwell would possibly take a greater share of hyperscalers’ budgets amidst a competitive AI landscape in the cloud, while emphasizing the supply chain’s role in affirming strong AI demand into 2025.

The market’s growing demand is so strong that Amazon is developing its own high-performance chips, Trainium, aiming to provide clients with competitive AI workload solutions. Microsoft is also venturing into new AI accelerator lines, Maia 100, to train large-language models, potentially reducing reliance on Nvidia and delivering cost-effective alternatives to Azure cloud customers.

However, the escalating demand has tested supply chain capacities. Taiwan Semiconductor (TSM), a crucial player in the supply chain, reported record quarterly profits and forecasted revenue growth of around 30% for the year, noting customer demand surpassing supply capabilities, implicitly referencing Nvidia.

Nvidia is projected to post robust earnings when it releases its financial results for the quarter ending in October. The company has forecasted current-quarter revenue of approximately $32.5 billion, more than doubling from the previous year’s equivalent period, despite facing delays in shipping its new Blackwell processors caused by design changes and supply-chain issues.

Shares of Nvidia saw a 2% increase in Friday trading, closing at $135.37 each, extending the stock’s six-month growth to approximately 63%.