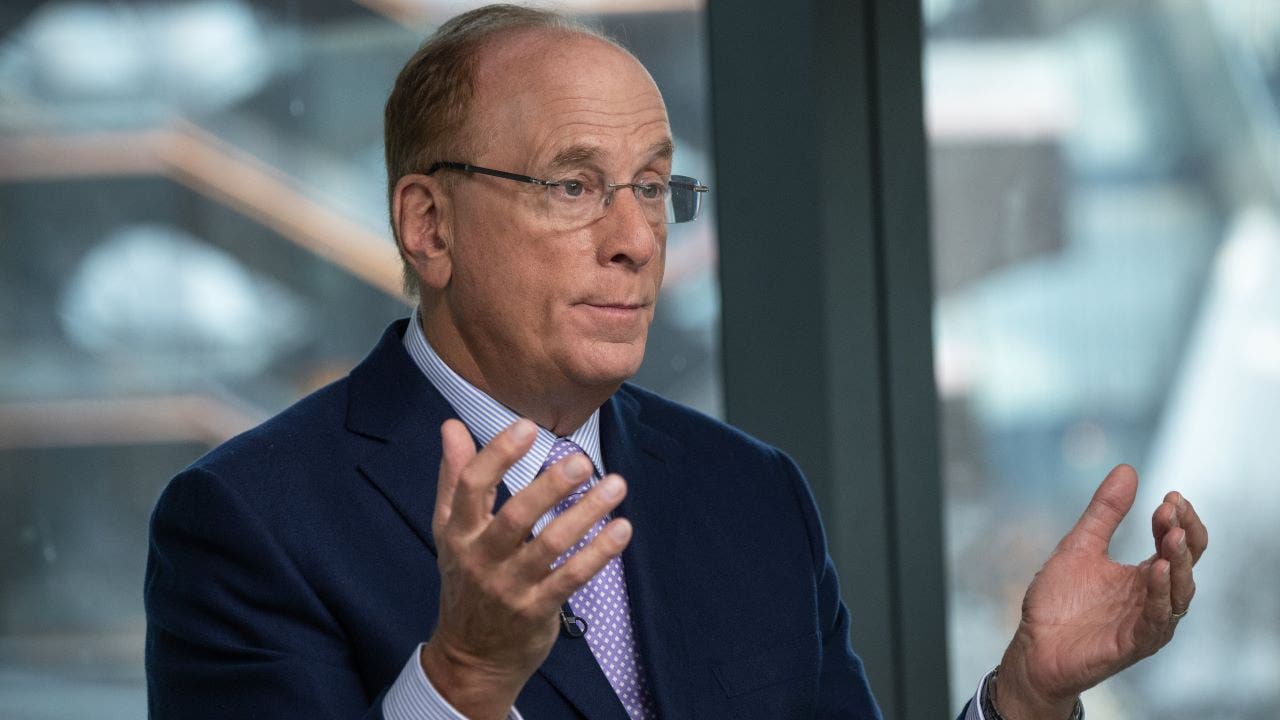

Saphyre Vice Chairman Wolfgang Koester expressed his enthusiasm for the fintech sector, provided an outlook on upcoming earnings, and previewed the October jobs report. Meanwhile, during a roundtable discussion at the annual Future Investment Initiative in Saudi Arabia, BlackRock CEO Larry Fink expressed skepticism regarding the anticipated extent of interest rate cuts by the Federal Reserve, citing concerns over persistent inflation.

Fink, who leads the world’s largest asset management firm, was questioned about the extent to which the central bank might reduce rates by the end of 2024. He suggested a minimum reduction of 25 basis points might be expected but emphasized his belief in the presence of “greater embedded inflation” in the global economy. The Federal Reserve had previously reduced rates by 50 basis points in September, marking its first rate cut in four years and adjusting the benchmark federal funds rate to a range of 4.75% to 5%. Following this adjustment, analysts at JPMorgan predicted two additional rate cuts by the end of the year, with further reductions continuing into 2025.

Although a Labor Department report indicated that inflation cooled in September to its lowest level in three years, the consumer price index still rose by 2.4% compared to the previous year, surpassing expectations. Despite these indications of easing inflation pressure, price levels remain above the Federal Reserve’s target of 2%. The persistent inflation has imposed significant financial burdens on many U.S. households, forcing them to allocate more income to daily necessities such as food and rent.

At the Future Investment Initiative, Fink remarked on various governmental and policy factors contributing to inflation, including immigration and on-shoring policies. He emphasized the increasing inflationary nature of these policies and questioned the broader economic costs involved. Fink further suggested that the economy of the past, characterized by consumer-driven dynamics and a focus on cost-effective products, has evolved into one where governmental policies have led to entrenched inflationary pressures, potentially preventing interest rates from falling as low as some predict.