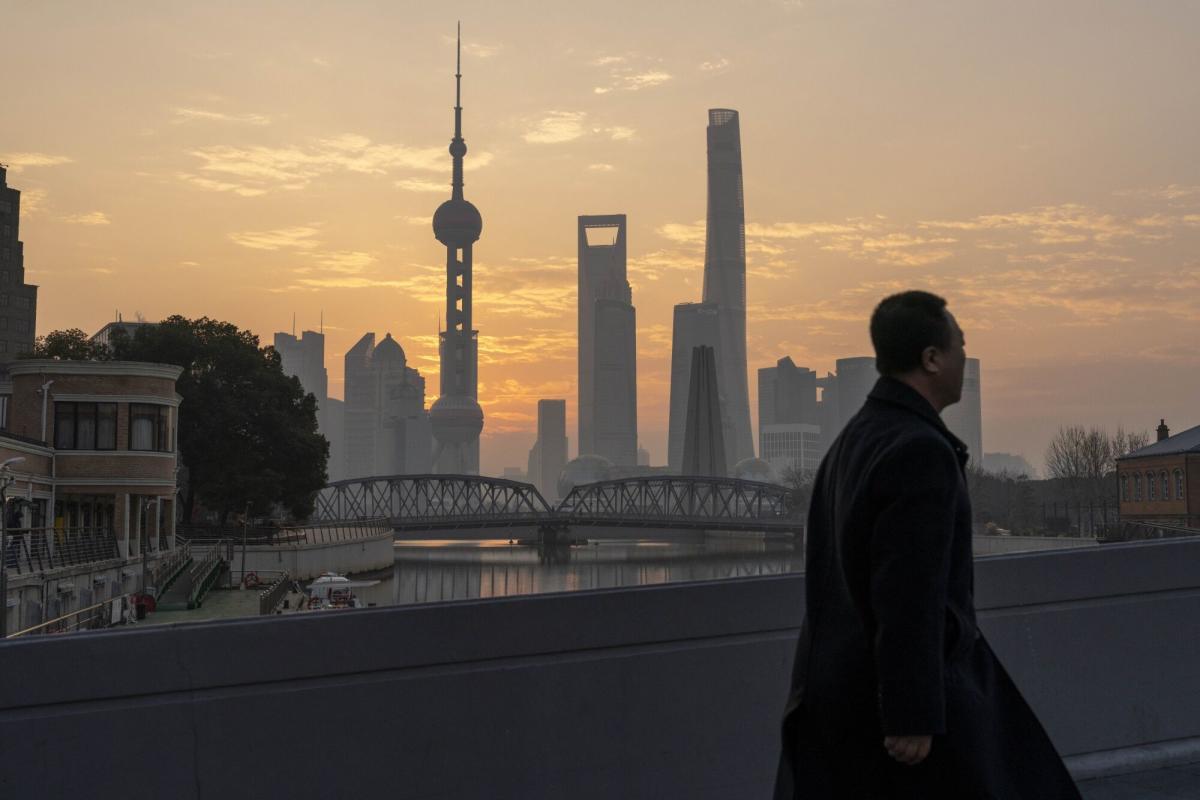

Stocks in Asia gave up some of their earlier gains while investors weighed the potential implications of China’s efforts to support the market. Along with this, a series of cautious remarks from Federal Reserve officials added uncertainty. Despite this, a gauge of Asian equities reached its highest point in more than a month. Significant earnings reports from companies including Toyota, Mitsubishi Corp and Daikin also factored into the Asian market. Stocks in Japan were relatively static while contracts for the US and Europe showed little change.

The market outlook was positively influenced by expectations of official support for Chinese markets, as well as the delayed impact of talks of a Fed rate cut. However, this optimism is seen as temporary, with band-aid measures unlikely to resolve China’s fundamental economic issues. Bonds experienced a rebound in the US session and the US dollar steadied following a prior drop. Despite the mixed market reception, some businesses have experienced gains. These include Toyota, which increased its operating income guidance, Mitsubishi Corp, which announced a share buyback and better-than-expected quarterly earnings, and Yum China Holdings Inc., which soared due to a stellar sales performance.

Various sources of volatility are imminent in the market, including the ongoing Lunar New Year holiday, China’s possible market stabilization efforts, and drivers such as an industrial production report and earnings from the likes of Walt Disney. The yield on 10-year US Treasuries reversed, along with those of Japan and Australia. Conversely, government bond yields rose in New Zealand after a strong jobs report was released, suggesting a cautious rate-cut approach by the central bank. In commodity markets, oil traded within a narrow range in the wake of geopolitical tensions in the Middle East and expanded stockpiles in the US. President Joe Biden also hosted German Chancellor Olaf Scholz at the White House, marking a high-level political event amid market fluctuations.

Cryptocurrencies, too, witnessed fluctuation, while Fed officials reiterated the central bank’s pledge to hold off on policy easing. All these factors contributed to a drip by drip approach for both risk assets and safe-havens in Asia.